bear trap stock term

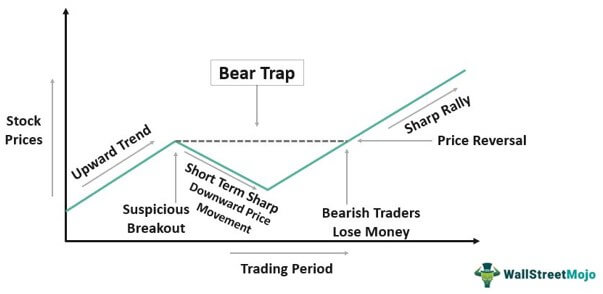

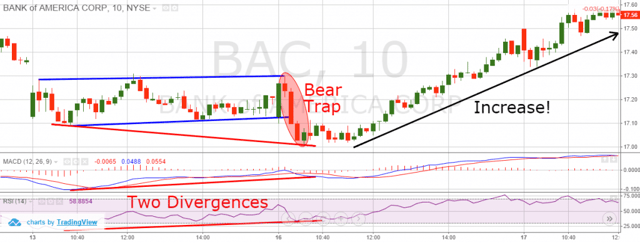

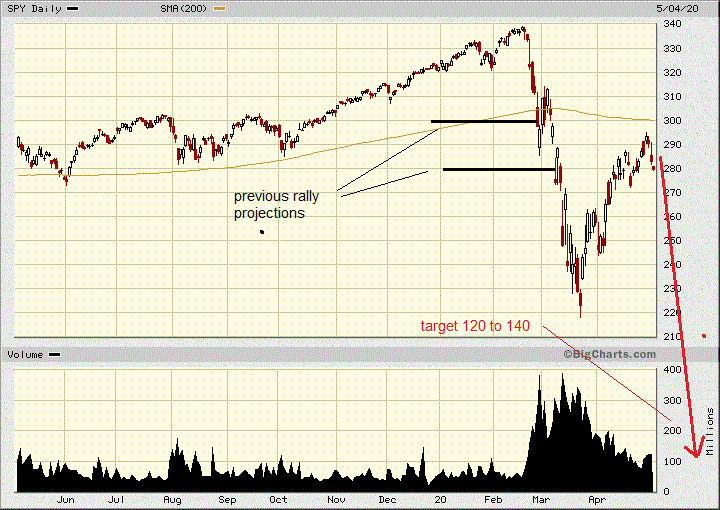

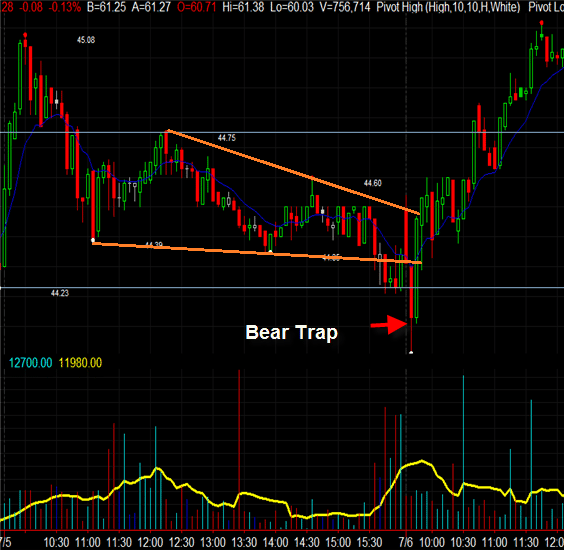

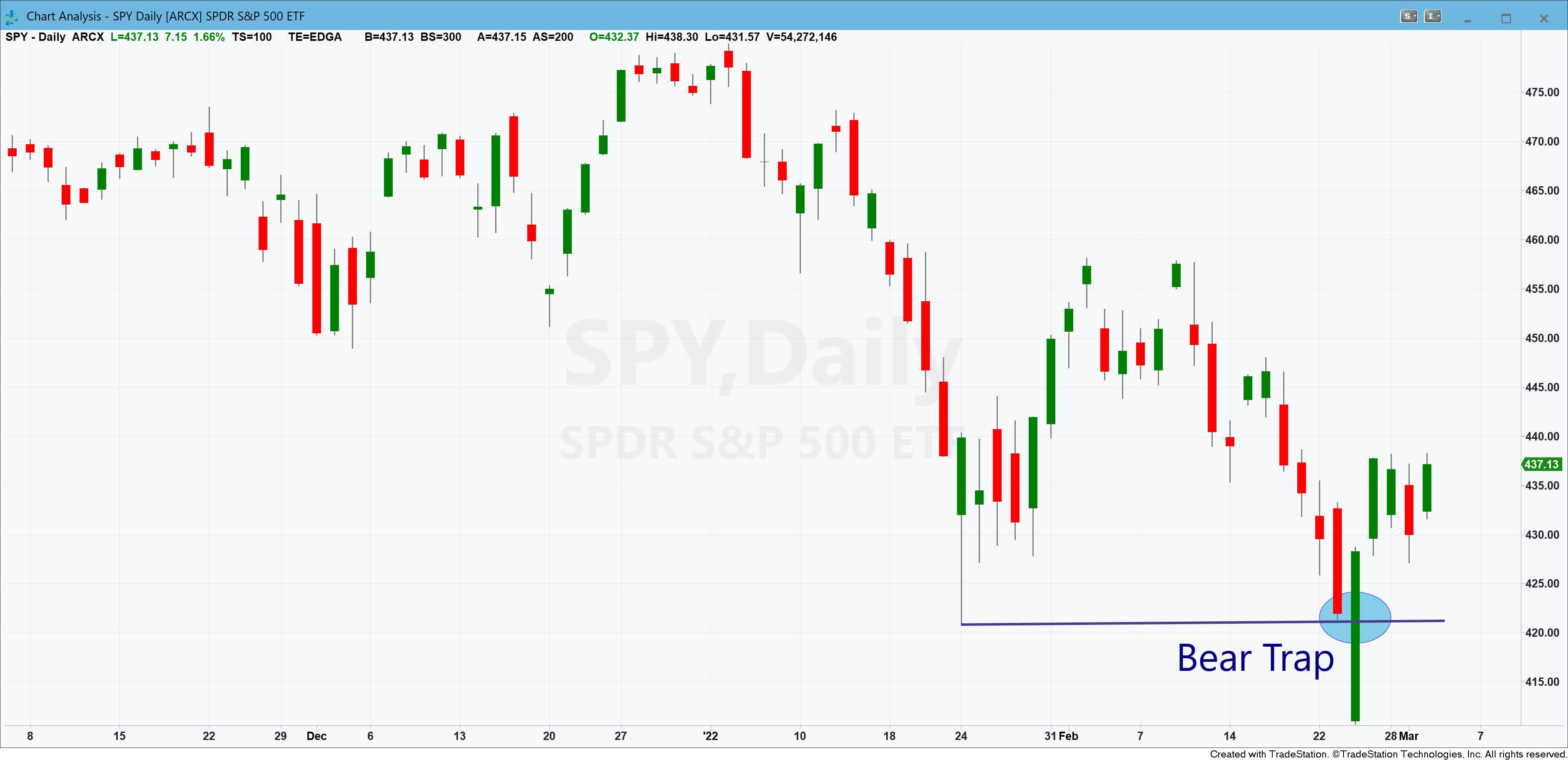

However instead of continuing to fall the stock reverses and moves past its prior high. This causes traders to open short positions with expectations of profiting from the assets price decline.

The Great Bear Trap Bull Trap Seeking Alpha

What is a Bear Trap.

. They accomplish this by driving prices lower in order to create the illusion that the stock or market is turning pessimistic. Its a technical pattern where the price dips or starts falling then quickly reverses upwards. A bear trap is a colloquial trading term used to describe common situations in the market that seem to indicate an imminent downturn in a security but actually result in a steady or rising priceprice.

An accumulation of shares being sold short by bears trying to drive down the price of a stock. Rising stock prices cause losses for bearish investors who are now trapped Typically betting against a stock requires short-selling margin trading or derivatives. A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside.

Ad Ensure Your Investments Align with Your Goals. Bear traps occur when investors bet on a stocks price to fall but it rises instead. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

A bear trap is the opposite of a bull trap. The bear trap occurs when the bears find they must repurchase the shares from an individual or a group at an artificial price determined by the seller. Bear Trap is a term that indicates trading situations when a certain stock s price is going downward for a long period of time but suddenly reflects a misleading upward sloping that results in a trap for the short seller.

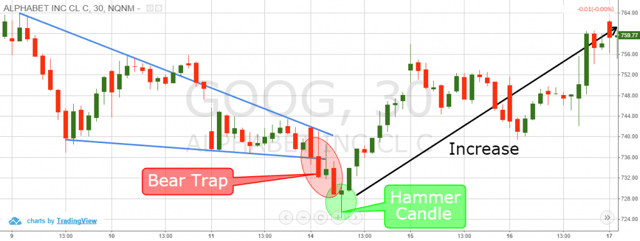

A Bear Trap occurs when a stock that has been declining suddenly reverses and starts to rise. A bear trap is a technical stock trading pattern reflecting a misleading reversal of an upward trend in the financial market. Find a Dedicated Financial Advisor Now.

In general a bear trap is a technical trading pattern. Ad See how Invesco QQQ ETF can fit into your portfolio. It happens when the price movement of a stock index or other financial instruments wrongly suggests a trend reversal from an upward to a downward trend.

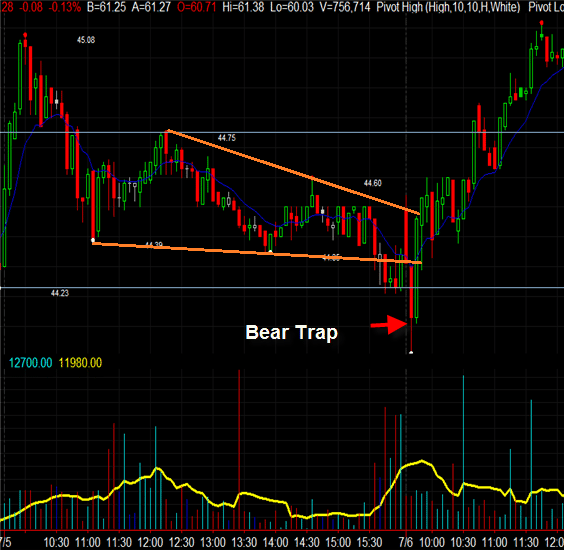

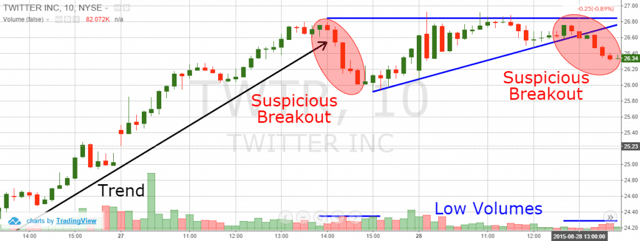

Investors and traders take short positions thinking that the rally is over. As the name itself suggests a bear trap is basically a situation when forex traders think that a support level is breaking and so as soon as price moves below the support level they start selling due to the supposed breakout. A bear trap occurs when the stock that had been trending upward has a sudden price reversal and starts dropping but the decline is temporary and it quickly reverses course again.

A bear trap stock is a downward share price that lures investors to sell short but then sharply reverses with the price moving positively. A bear trap is common when trading various assets such as stocks currencies and commodities. Bear traps spring as brokers initiate margin calls against investors.

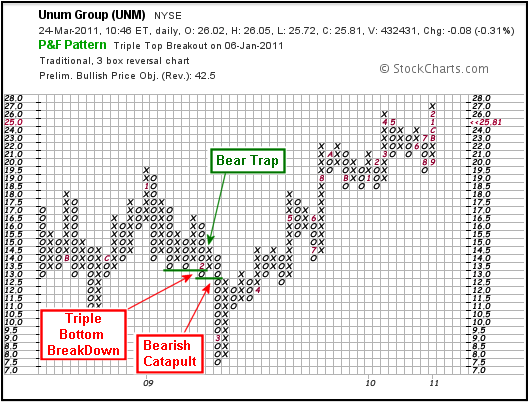

This type of false indication is basically a trap where traders tend to get fooled and fall for it. What is a Bear Trap. A bull trap is a false signal indicating that a declining trend in a stock or index has reversed and is heading upwards when in.

A bear trap is a trading term used to describe market situations that indicate a downturn in prices but actually leads to higher prices. Searching for Financial Security. Essentially the bear trap is designed to encourage investors to buy at a higher price with the anticipation that during the.

Bear Trap Stock is a term used in the stock market to describe a particular type of investment. As traders who generally go short on downtrends bearish investors are vulnerable to these deceptive market events. The assets price quickly recoups the losses suffered in the short-term dip defying trader expectations.

Hence a false reversal of a declining price trend can be described as the trap. The creation of a bear trap involves the careful planning and execution of a set of circumstances in which there is sense of an impending short term fall in the price of a given security that will be followed by a long term upswing in the price. It is a false indication of a reversal from an uptrend into a downtrend.

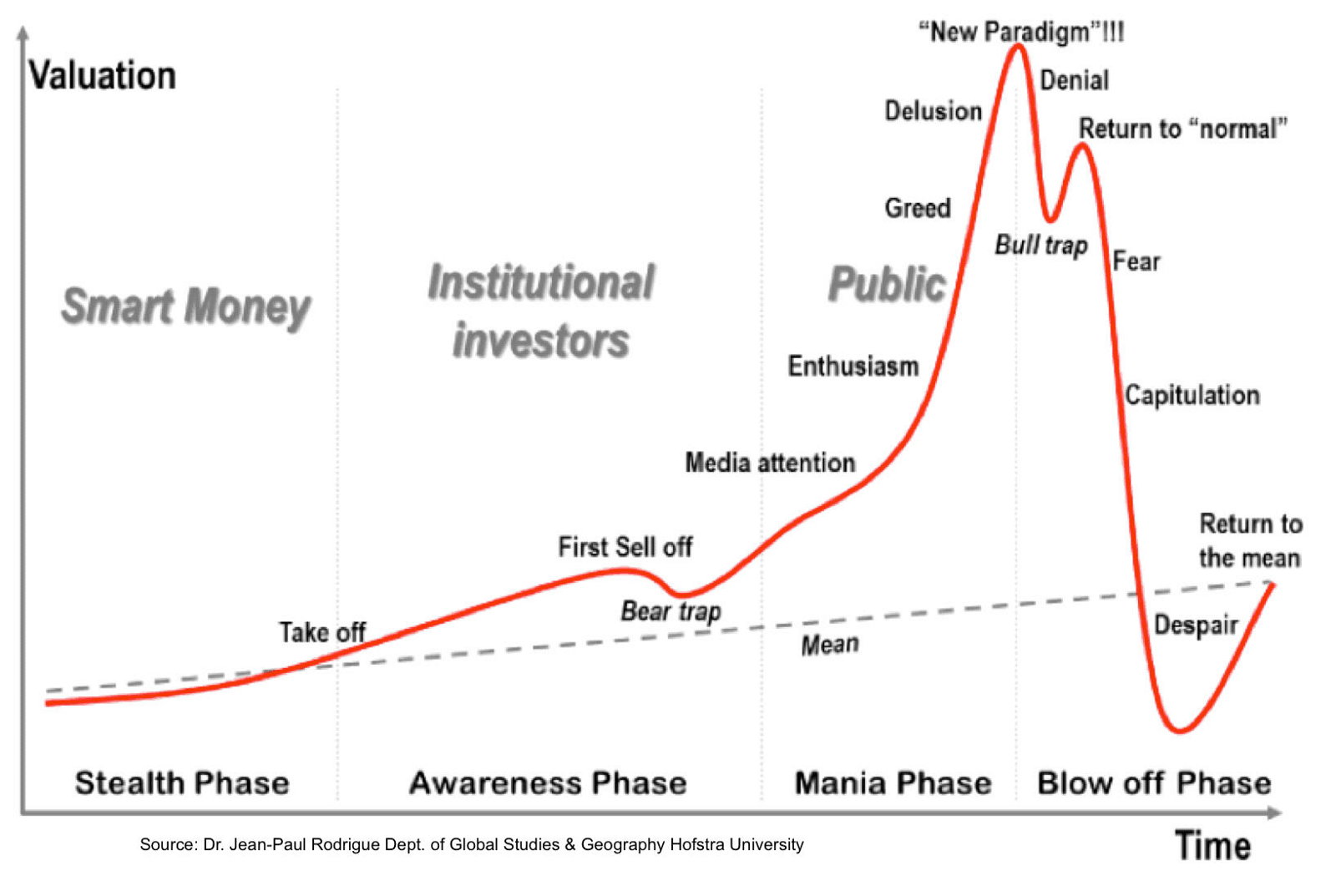

Institutions must weed out amateurnovice traders in order to increase demand and drive stock prices upward. A Bear Trap is a device that is used to capture bears. Many investors who have been watching the stock decline will sell it at this point because they believe that the trend has reversed and the stock will continue to go down.

Discover the Power of thinkorswim Today. Our Financial Advisors Offer a Wealth of Knowledge. Bear traps can result in major losses for short-sellers meaning those who bet against a stock by selling borrowed shares when they expect the price to drop.

P F Bull Bear Traps Chartschool

Bear Trap Stock Trading Definition Example How It Works

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap Seeking Alpha

Bear Trap Explained For Beginners Warrior Trading

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

/Clipboard01-c2c4a2d12c05468184b82358f12a1af5.jpg)